Over the past 30 years, the value of inheritances has risen substantially in the UK. This raises some interesting dilemmas for society and individuals. For society, there are questions of equality and fairness. For individuals, there are questions of what to do with their wealth – spend it or give it away. This article explores these dilemmas and considers how philanthropy can help resolve them.

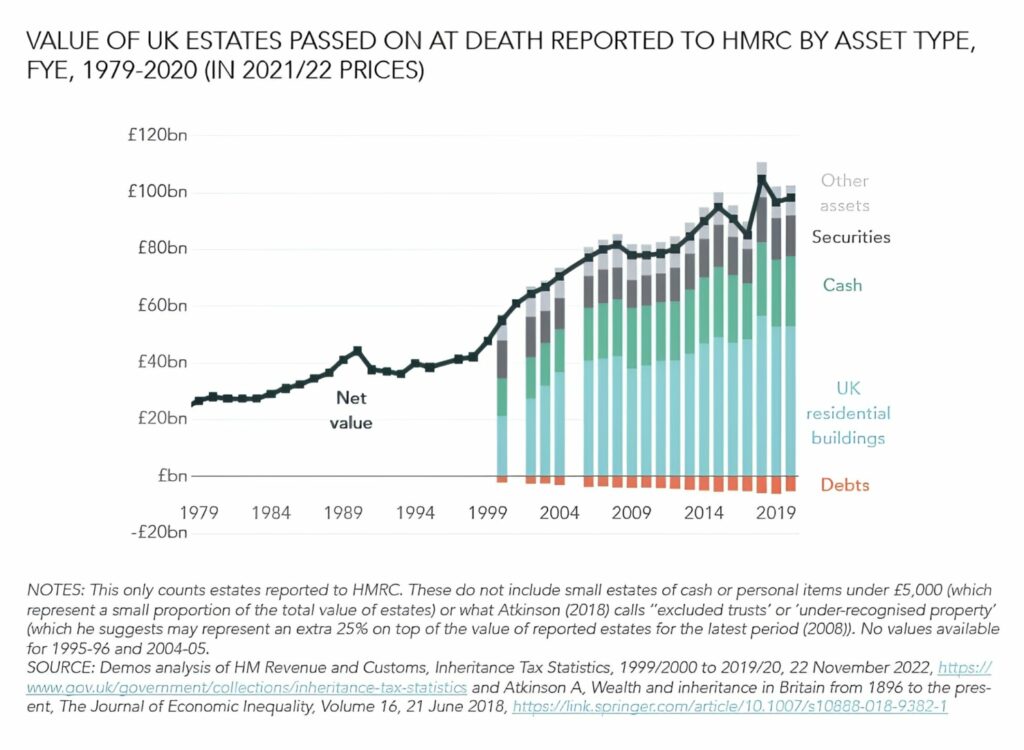

In January 2023, Demos launched a fascinating report titled A New Age of Inheritance: What Does It Mean for the UK? The report shows how the value of wealth – driven in particular by rising house prices – has increased substantially over recent decades. As illustrated in the graph below, this rise in wealth has translated into substantial growth in the value of estates passed on at death.

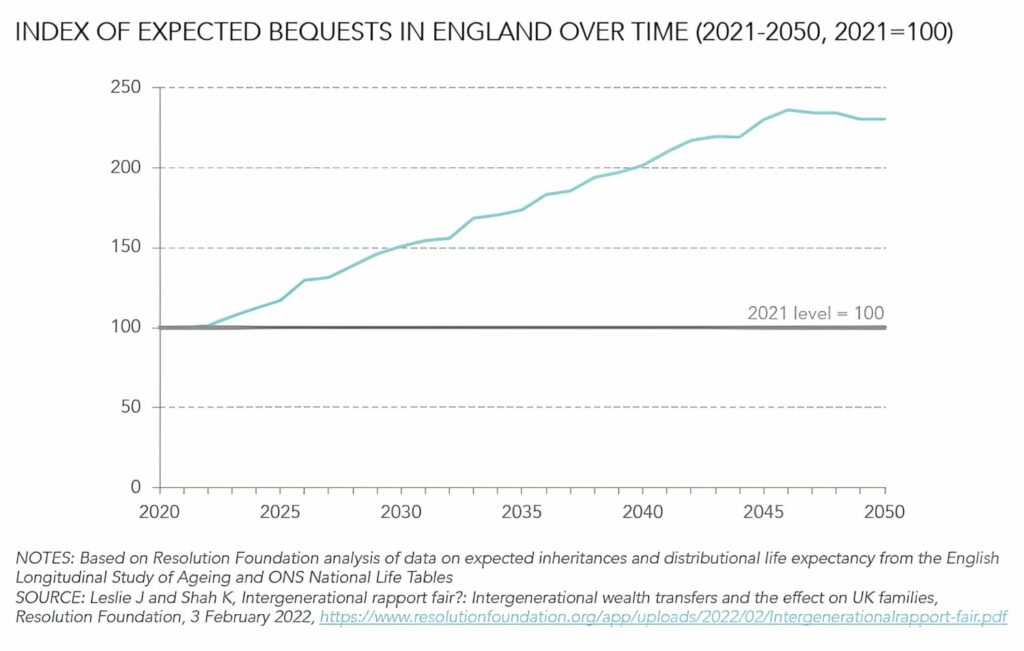

Inheritances in the UK are now estimated to be worth over £100 billion per annum. Even after inflation, inheritances grew 36% faster than national income between 1990 and 2020. The Demos report also suggests that the value of estates will grow further over the next 25 years, as shown in the graph below.

Many inheritances pass to younger generations, which helps family members get on (or move up) the housing ladder, start a business or retire early. For those that inherit wealth, it can be life-changing and boost living standards. However, many people in society will receive little or no inheritance. As such, continued growth in the value of inheritances is likely to exacerbate wealth inequalities in the UK.

Taxation on estates passed on at death is one potential route to reducing wealth inequalities. Inheritance Tax (IHT) raised £6.1bn in the UK in 2021-22, and the Office for Budget Responsibility forecasts IHT will increase to £7.8bn by 2027-28. However, IHT is an emotive subject and is often regarded as a double taxation because people have already paid income tax during their lifetime. A YouGov poll from 2022 found that 67% of the population opposed increasing the current 40% IHT rate.

More creative solutions are needed to harness wealth for the common good. One way of doing this could be via charitable giving, which remains an under-utilised mechanism for redistributing wealth. Although charitable giving is a feature of much estate planning, the Demos report notes that £1.7 billion of inheritance wealth was given to charities in the 2019-20 fiscal year. This represents less than 2% of the total value of inheritances each year.

Current rules (as of 19th February 2023) allow cash or physical assets left to a qualifying charitable body, either during one’s lifetime or in a will, to be exempt from IHT. A reduced rate of IHT (36% rather than the standard 40%) is also available to those that leave at least 10% of their net estate to charity. Yet, even with these inheritance tax reliefs, the scale of charitable giving remains low. We can, and perhaps should, do more to encourage people to transfer wealth to charity.

A recent report by Pro Bono Economics for the Law Family Commission on Civil Society called on the Financial Conduct Authority (FCA) to improve the quality and quantity of financial advice and guidance on philanthropy in the UK. The report recommended that the FCA make philanthropy advice training mandatory for financial advisors and introduce regulations to ensure it is discussed with clients. If taken up, this recommendation has the potential to expand philanthropy in the UK.

At The Charity Service, we are fortunate to work alongside some excellent financial advisors prepared to discuss philanthropy with their clients. As a result, their clients are engaging in substantial lifetime charitable giving. Whilst individuals are naturally keen to maintain enough money to sustain their lifestyle and ensure that their family is well catered for, some clients have come to realise they have enough wealth to give some of it away.

Donors that give away wealth during their lifetime say they enjoy the experience. For them, lifetime charitable giving is often preferable to leaving a gift on death because they get to see the benefits of their philanthropy. If they do not need the money to maintain their desired standard of living, this can be a life-fulfilling decision.

Donor Advised Funds (DAFs) are also making it easier for large donors to give away wealth. Established under an umbrella charity that administers the fund on behalf of the donor, DAFs offer a cost-effective alternative to setting up a charitable foundation. DAFs allow donors to give away wealth both during their lifetime and in their will, and gifts into DAFs are also usually eligible for UK tax reliefs. After setting up and funding a DAF, donors can make grants to charities throughout their lifetime and stipulate arrangements for how funds should be distributed to charities after their death. This can include arrangements for appointing family members to advise on the funds. DAFs thereby provide a flexible vehicle for charitable giving. Indeed, more and more people are beginning to recognize the benefits of DAFs, which are making DAFs the fastest growing vehicle for charitable giving in the UK.

Overall, it is clear that there is enormous potential in the UK to transfer more private wealth to charities so that it can be used for the common good. DAFs are already helping to unlock some of this wealth, although their full potential won’t be realised unless all financial advisors discuss philanthropy with their clients. If current wealth management systems cannot be reformed to encourage more wealth transfer to charitable causes, we shouldn’t then be surprised if future governments eventually step in to raise taxes on wealth.

If you are interested in obtaining philanthropy advice and/or opening a Donor Advised Fund (DAF) with The Charity Service, please contact us.