Copyright © The Charity Service 2022

For Donors

We make charitable giving easy

The Charity Service provides services to donors to support their long-term charitable giving.

Our services include:

- Donor Advised Funds

- Philanthropy Advice

Donor Advised Funds

Donor Advised Funds (DAFs) are an increasingly popular vehicle for long-term charitable giving in the UK. They allow donors to make charitable contributions, immediately receive a tax benefit and make grants to charities over time.

Philanthropy Advice

The real value of any charitable gift is not in the amount given but in the impact. That's why adopting a strategic approach and carefully selecting charities is important. Our philanthropy advice service can help you give with confidence.

Donor Advised Funds

Making charitable giving easy with Donor Advised Funds

We understand that giving large amounts of money to multiple charities can be time-consuming and administratively burdensome.

Our donor advised funds take the hassle out of long-term charitable giving by:

- making it easy to claim Gift Aid tax relief;

- looking after all administration;

- letting you concentrate on what charities to support; and,

- allowing you to give to charities anonymously, if you wish.

We invest funds and grow them tax-free to support your long-term charitable giving. We always invest funds ethically because monies intended for good causes should make a positive difference to society and the environment.

You can give with confidence knowing that we carry out checks on every charity.

We provide regular statements listing all your contributions, grants, fees and investment performance. We also work seamlessly alongside your other advisors when required.

You can open a Donor Advised Fund with The Charity Service with an initial donation of £250,000 (including Gift Aid). If you are a top-rate taxpayer and are eligible to claim Gift Aid, a £250,000 donation may only cost you £137,500.

To find out more about our Donor Advised Funds, please book an appointment with one of our team.

Philanthropy Advice Service

Empowering impactful charitable giving

We know that donors care about the causes they support and want to get the most out of their charitable giving. We also understand that choosing charities can be overwhelming and that it is often difficult to access trusted information and guidance.

We offer philanthropy advice services tailored to your unique personal values and interests.

Our expert advisors will help you to:

- find a focus for your charitable giving;

- develop an effective strategy;

- select charities to support; and,

- monitor progress and make changes if needed.

With our help, you can make informed decisions and maximise the impact of your giving.

Our expert advisors have a deep knowledge of the charity sector. We also draw upon research-based evidence for all our advice.

We aim to make the giving process enjoyable and fulfilling, and we love working with thoughtful and engaged donors.

To find out more about our Philanthropy Advice Service, please book an appointment with one of our team.

Research, Insight and News

Read the latest articles on philanthropy from The Charity Service.

Getting Started With Your Philanthropy – A North Wes

We recently held the first North West Philanthropy Network webinar on the topic of ‘Getting Started with Your Philanth

Continue Reading

Due Diligence for Grant Recipients – the TCS Approac

An important part of our work is undertaking due diligence on our grant recipients. We do this for both our Greater Manc

Continue Reading

Anonymous Giving Through a Donor Advised Fund

This blog post is about anonymous giving in particular the reasons donors might want to remain anonymous, how a Donor Ad

Continue ReadingFAQs

The minimum initial donation required to open a Donor Advised Fund account is £250,000. If you are a top rate tax payer and are eligible to claim Gift Aid, a £250,000 donation may only cost you £137,500. Once your account is opened, additional contributions can be made at any time thereafter in amounts of £5,000 or more.

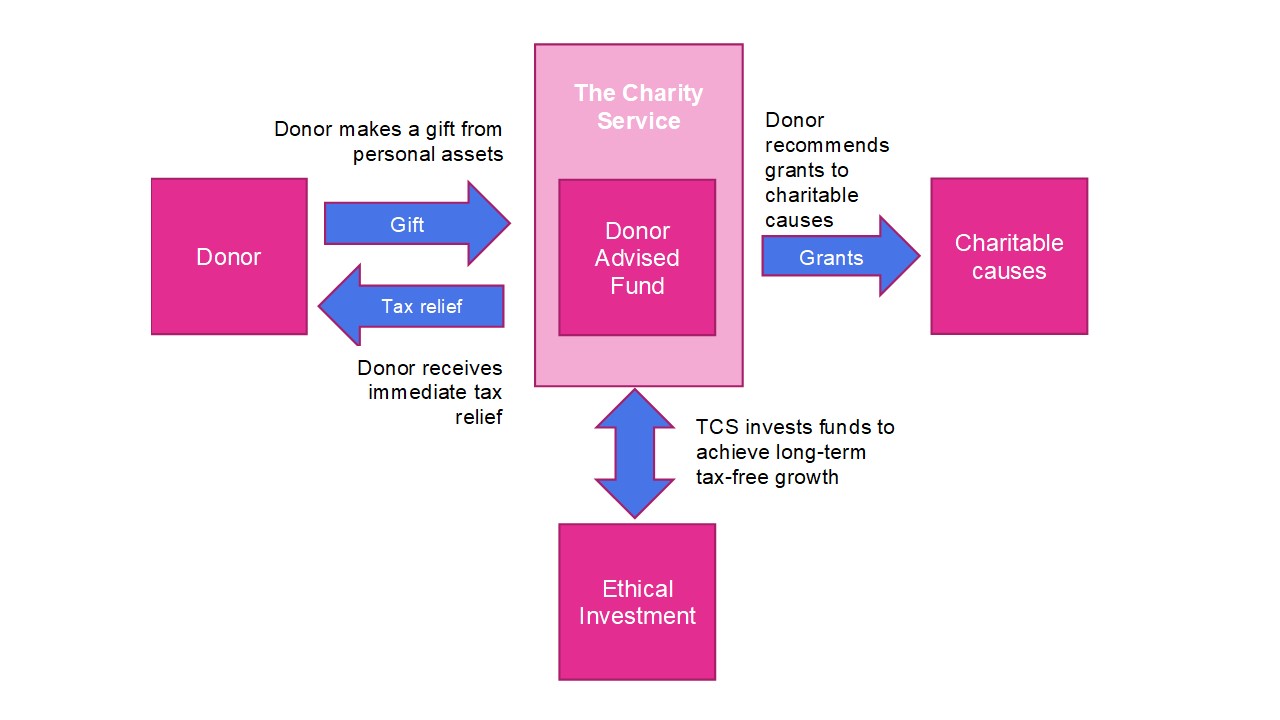

The diagram below summarises how a Donor Advised fund works.

The Charity Service is a registered charity established to support philanthropic giving. We are not looking to make a profit, but aim to cover our costs. Each Donor Advised Fund is subject to a quarterly account administration fee which is levied on the value of the fund. Our fee rates are tiered and, for the largest funds, can be as low as 0.15% per annum. We also make small charges for overseas and other specialist grants as this usually requires us to perform additional due diligence checks. Where funds are invested, funds are also subject to the investment manager’s fees.

Yes, absolutely. When setting up a Donor Advised Fund, you can nominate advisors and successors on your account. This means that family members can get involved now and/or in the future. These arrangements can also be changed, so as your personal and family circumstances change you can reflect these in your fund.