Copyright © The Charity Service 2022

For Donors

We make charitable giving easy

The Charity Service is a UK-based Donor Advised Fund sponsor and grant-making charity. We provide services to donors to support their long-term charitable giving drawing on over 35 years of expertise.

Our services for donors include:

- Donor Advised Funds

- Philanthropy Advice

Donor Advised Funds

Donor Advised Funds (DAFs) are an increasingly popular vehicle for long-term charitable giving in the UK. They allow donors to make charitable contributions, immediately receive a tax benefit and make grants to charitiable organisations in the UK and overseas over time.

Philanthropy Advice

The real value of any charitable gift is not in the amount given but in the impact. That's why adopting a strategic approach and carefully selecting charities is important. Our philanthropy advice service can help you give with confidence.

Donor Advised Funds

Making charitable giving easy with Donor Advised Funds

We understand that giving large amounts of money to multiple charities can be time-consuming and administratively burdensome. Donor Advised Funds can be an ideal solution to allow you to focus on your giving whilst we take care of the administration.

Our donor advised funds take the hassle out of long-term charitable giving by:

- making it easy to claim Gift Aid and other tax relief;

- looking after all administration;

- letting you concentrate on what charities to support; and,

- allowing you to give to charities anonymously, if you wish.

We can invest funds and grow them tax-free to support your long-term charitable giving. We always invest funds ethically because monies intended for good causes should make a positive difference to society and the environment. You can find out more about our approach to investment here.

You can give with confidence to charitable organisations including registered charities, CICs and constituted community groups both in the UK and overseas knowing that we carry out checks on every organisation you support.

We provide regular statements listing all your contributions, grants, fees and investment performance. We also work seamlessly alongside your other advisors when required.

You can open a Donor Advised Fund with The Charity Service with an initial donation of £100,000 (including Gift Aid). If you are a top-rate taxpayer and are eligible to claim Gift Aid, a £100,000 donation may only cost you £60,000.

To find out more about our Donor Advised Funds, please book an appointment with one of our team.

Philanthropy Advice Service

Empowering impactful charitable giving

We know that donors care about the causes they support and want to get the most out of their charitable giving. We also understand that choosing charities can be overwhelming and that it is often difficult to access trusted information and guidance.

We offer philanthropy advice services tailored to your unique personal values and interests.

Our expert advisors will help you to:

- find a focus for your charitable giving;

- develop an effective strategy;

- select charities to support; and,

- monitor progress and make changes if needed.

With our help, you can make informed decisions and maximise the impact of your giving.

Our expert advisors have a deep knowledge of the charity sector. We also draw upon research-based evidence for all our advice.

We aim to make the giving process enjoyable and fulfilling, and we love working with thoughtful and engaged donors.

To find out more about our Philanthropy Advice Service, please book an appointment with one of our team.

Research, Insight and News

Read the latest articles on philanthropy from The Charity Service.

Converting a Charitable Trust to a Donor Advised Fund

For people looking to make significant ongoing gifts to charities their first thought is often to establish their own Ch

Continue Reading

The Charity Service Welcomes Tribe Impact Capital as New I

At The Charity Service (TCS), we believe that funds set aside for charitable giving should be invested ethically and res

Continue ReadingGetting Started With Your Philanthropy – A North Wes

We recently held the first North West Philanthropy Network webinar on the topic of ‘Getting Started with Your Philanth

Continue ReadingFAQs

The minimum initial donation required to open a Donor Advised Fund account is £100,000. If you are a top rate tax payer and are eligible to claim Gift Aid, a £100,000 donation may only cost you £60,000. Once your account is opened, additional contributions can be made at any time thereafter in amounts of £5,000 or more.

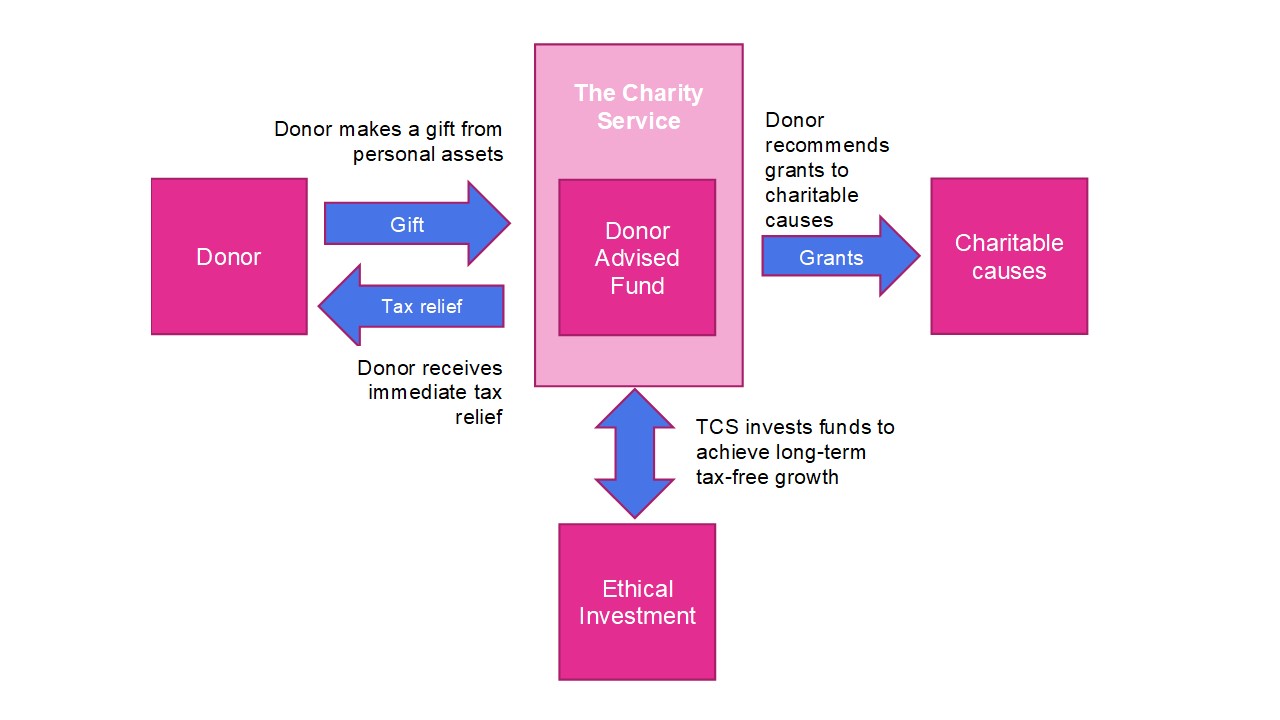

Donor Advised Funds (DAFs) are an increasingly popular vehicle for long-term charitable giving in the UK. They allow donors to make charitable contributions, immediately receive a tax benefit and make grants to charitiable organisations in the UK and overseas over time. The diagram below summarises how a Donor Advised fund works.

The Charity Service is a registered charity established to support philanthropic giving. We are not looking to make a profit, but aim to cover our costs. Each Donor Advised Fund is subject to a quarterly account administration fee which is levied on the value of the fund. Our fee rates are tiered and, for the largest funds, can be as low as 0.15% per annum. We also make small charges for overseas and other specialist grants as this usually requires us to perform additional due diligence checks. Where funds are invested, funds are also subject to the investment manager’s fees.

Yes, absolutely. When setting up a Donor Advised Fund, you can nominate advisors and successors on your account. This means that family members can get involved now and/or in the future. These arrangements can also be changed, so as your personal and family circumstances change you can reflect these in your fund.

You can recommend organisations that you would like to support including registered charities, Community Interest Companies (CICs) and constituted community groups. You can give to organisations both in the UK and overseas. However, we undertake due diligence on each organisation you recommend for support and in rare cases may decline the grant if we have serious concerns about the organisation’s finance, governance or whether the funds will be used for charitable purposes. Under these circumstances we will talk to you about alternative organisations to support.