For people looking to make significant ongoing gifts to charities their first thought is often to establish their own Charitable Trust. This is a legal structure which allows funds to be ringfenced for charitable purposes. The Trust is registered with the Charity Commission, trustees are appointed and they are legally responsible for distributing grants in line with the Commission’s guidance including undertaking due diligence on charity recipients and providing financial reporting information to the Commission.

Over time it may become harder for trustees to meet their regulatory obligations in managing their charitable trust and they may find the administration required to be burdensome. Some trustees find their focus is taken up by meetings, due diligence, accounting and audit and reporting rather than the pleasure of making gifts to worthwhile charities. Occasionally disputes between trustees arise especially when one trustee feels that they are shouldering the administrative responsibility of the Trust.

In these cases trustees can explore options on how manage their Trust and philanthropic giving in a way that works better for them. This may include converting their Trust to a Donor Advised Fund.

What is a Donor Advised Fund?

A DAF is a philanthropic fund held by a registered charity such as The Charity Service which allows major donors to make a charitable donation, receive immediate tax relief and then recommend grants over a period of time (typically several years). Donors may choose to make further donations into their DAF to support their long term giving strategies. DAFs are a growing vehicle for charitable support in the UK due to the low administrative burden, immediate tax relief and flexibility they offer.

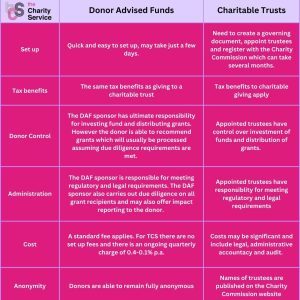

Comparison between a Donor Advised Fund and a Charitable Trust

There is a summary of the key points of difference between a DAF and a Charitable Trust in the table below. In short, DAFs are legally managed by a DAF advised sponsor such as The Charity Service. The sponsor is responsible for all the administration of the trust including due diligence and reporting. The donor is able to recommend grants to charities and other organisations and is better able to focus on their giving without worrying about legal and compliance issues.

Is it possible to convert a Charitable Trust to a Donor Advised Fund?

Yes, it is possible to convert a Charitable Trust to a DAF. If this is of interest to you then we recommend contacting our Head of Philanthropy, Rachel Tomlins at [email protected] to discuss your specific circumstances.

Common Questions and their Answers

When considering a move from a Charitable Trust to a DAF some common questions are:-

- Will trustees still have full control over their grant making?

Donors are able to recommend grants to charities and other organisations both in the UK and overseas. However the DAF sponsor is ultimately responsible for approving requests and releasing funds. Typically the DAF sponsor will carry out a due diligence process on recipients to ensure that the funds are used for charitable purposes as well as ensuring appropriate financial and governance structures are in place. Many donors find this to be reassuring as it gives them confidence that their gift will be used effectively. In the rare instances that a grant request is not approved The Charity Service will discuss this with the donors and work to find a suitable alternative.

- How will decision-making work?

When the DAF is established the donor nominates the person/people responsible for recommending grants. At The Charity Service this includes Founders who are able to recommend grants, nominate successors and make other decisions e.g. around investments, anonymity etc. Founders are also able to nominate Secondary Advisors and to define their role e.g. to recommend grants but not have further decision-making responsibilities.

- Will the charity recipients know and acknowledge the source of their funding?

It is possible for grants from a DAF to be completely anonymous. Alternatively we can include an award letter requesting that the grant be acknowledged in a particular way e.g. “The John and Mary Trust.”

- How will compliance and due diligence concerns be met?

The Charity Service is responsible for all compliance and due diligence requirements. We follow comprehensive and well established processes to allow donors to focus on their giving.

- Will trustees still have legal responsibilities over the DAF?

No, the ultimate legal responsibility for the DAF lies with The Charity Service.

- How long can a DAF remain active? What will happen in the future?

There is no time limit on how long a DAF can remain active. We encourage regular grant-making but do not set a minimum grant-making level. It is also possible to add additional funds to the DAF. Should the named Founders for the DAF pass away it is possible to nominate a successor or to provide The Charity Service with information on how you would wish the funds to be distributed after your death. The Charity Service can also continue to make grants after your death in line with your pattern of giving or wishes if that is your preference.

- What are the costs associated with a DAF?

There are management fees associated with the running of the DAF. For The Charity Service these are currently 0.4-0.1% p.a. with a minimum quarterly charge of £650.

Summary

Ultimately, converting a Charitable Trust to a Donor Advised Fund can offer a simpler, more flexible way to continue meaningful philanthropy while reducing administrative and regulatory burdens. For trustees who wish to spend less time on governance and compliance and more time supporting the causes they care about, a DAF can provide an attractive and effective alternative. By transferring responsibility for oversight and administration to an experienced sponsor, donors can preserve their philanthropic intent, maintain influence over grant-making, and ensure their charitable legacy is managed efficiently both now and in the future.

To find out more or to discuss your specific circumstances please contact Rachel Tomlins, Head of Philanthropy at [email protected].